Junior employees and other new hires have to spend a lot on accommodation when they relocate - deposit and first month’s rent are due well before their first paycheck arrives. This can be a stressful experience.

Other than just paying them a bonus, there are seven effective ways you can financially support them in their first few cash-strapped months and show that you care.

For many of us workplace veterans, our first job is a thing of the distant past. But those of us who, back in the day, relocated for their first job - we remember the financial pressure that came along with the move, especially with regards to finding a place to stay.

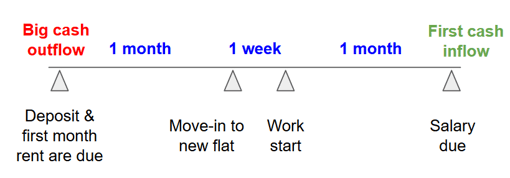

The problem relocating junior employees face can be summed up in one sentence:

Rent and deposit have to be paid at the beginning of the month - salary arrives at the end of the month.

On top of that, companies have a fixed calendar day for payroll cutoff and, on average, relocating employees pay deposit and first rent a full month before moving in and starting work. This can result in two months (or more) of negative cash flow:

All this could be solved through a starting bonus you pay to the employee. But in most cases, this is difficult to justify from an HR point of view, and it's also expensive.

We have identified seven alternatives of providing financial support to relocating junior employees. All of these methods are being used by companies we spoke to or are familiar with.

This is a brief run-down on the seven methods. We have written a white paper on the topic where we go into much more detail and give our rating on these methods along the lines of cost, tax friendliness, employee friendliness and employer risk. To find out which of the methods is the overall winner across these four dimensions, download the white paper here.

The seven methods, in no particular order:

1) Zero interest loan

Can be repaid over many months, offering the employee a soft landing: If designed well, it can mean that the employee, assuming a zero bank account balance at the beginning, never dips into the red. There are a few rules to follow on employer loans to employees, but none of them are cumbersome, especially if the loan value is less than £10k.

2) Salary advance

The cash that would have arrived at the end of the month comes at the beginning of the month instead. A salary advance has limited value given that the employee then has to wait for almost two full months for the second cash injection (second month’s salary, paid end of month 2.) - so the pain is usually only deferred and not eliminated.

But for the immediate use case of bridging a short-term cash gap, this method is better than nothing. Most importantly, it doesn’t cost the company anything other than some admin work. (This admin work, however, means bypassing the payroll process, which can be difficult in some companies.)

3) Own a block of flats

This is something that big and rich companies (or those with ties into the real estate market) can afford to do. Costly in nature (also because of cleaning/maintenance and running a booking system), but extremely employee friendly. If set up as a temporary accommodation scheme for the employee, it can also have significant tax benefits. (Read the full white paper for details and our article on tax savings via the Relocation Allowance.)

A drawback is the lack of scalability - as the company grows, it will will not maintain dozens or even hundreds of flats for the benefit of junior employees.

4) Rent and sublease to the employee

Similar to the ownership model, only less costly to the employer.

5) Guarantee to the landlord

The employer provides a rent payment guarantee to the employee’s landlord which removes the employee's need to pay a deposit and, in some cases, upfront rent. The benefit lies in rent being due at the same time the employee is getting paid.

This can be a cumbersome method: You need to review individual guarantee agreements, which can lead to legal risks. But apart from this hassle, it is a low-cost method that, provided the landlord is a trustworthy actor, will rarely results in a financial downside.

6) Prepaid debit card for the employee

We include this method for completeness’ sake only. It is mainly used for travel expenses and cannot be used for the big ticket item - landlords don’t usually accept payment via cards. It finds its main use with employees who (will) travel often and therefore incur expenses in different currencies.

Tax benefits accrue on those expenses that are relocation related. (for details on this, read our article on the Relocation Allowance)

7) Pay the temporary accommodation directly

This method is very tax efficient as you can deduct deposit and rent payments from the employee’s income tax bill (and you don’t pay National Insurance contributions either). The main requirement is that the accommodation is only temporary.

The scenario is that the employee arrives and you pay for, say, three months of temporary housing. During that time, the employee can accumulate some savings and then pay down the deposit and first month’s rent of a flat they will move into from month 4 onward.

You can justify this significant contribution to the employee’s bottom line by negotiating a lower salary in their first year of employment. Even if the salary difference is as high as the payment you make towards their rent, the employee is still better off due to the substantial tax advantage. (more details here, again, in our article on the Relocation Allowance)

Conclusion and further reading

These methods can be combined to maximise the employee’s cash benefit. No matter which method you choose, we believe it is worth your time to look into the subject. Not least, it will serve your efforts to recruit and retain the best talent.

Is there a method you know of that we forgot to include? Tell us at @benivohq or email us at sales@benivo.com.

For

- many more details on the methods,

- their detailed scoring and

- an extra bonus Method #8 which takes the crown with the highest score

...read our white paper on Financing Options for Relocating Junior Employees.

Image credit: Adobe